Medicare Part D is a voluntary prescription drug program available to Medicare beneficiaries. To encourage employers to continue offering prescription drug benefits to Medicare-eligible retirees, Medicare provides an employer subsidy through the Retiree Drug Subsidy (RDS) program.

The RDS is available to certain employers that sponsor group health plans providing retiree drug coverage. Eligible retirees must be entitled to Part D but not enrolled in it. Employers wishing to participate must apply to the Centers for Medicare & Medicaid Services (CMS) before the plan year begins.

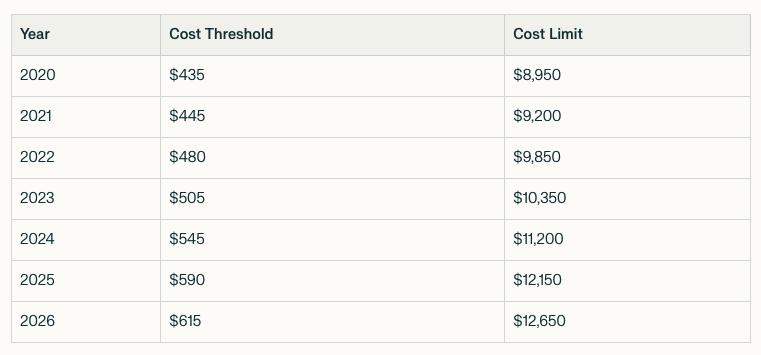

In general, the RDS equals 28 percent of each qualifying covered retiree’s prescription drug costs—between the annual cost threshold and the cost limit—that would otherwise be covered under Part D. This subsidy directly reduces employer costs for providing retiree prescription drug coverage.

RDS Parameters

A “qualifying covered retiree” is an individual who is Part D-eligible, is covered under an employment-based retiree health plan with qualified prescription drug coverage, and is not enrolled in a Part D plan.

Sequestration Impact

Under the Balanced Budget and Emergency Deficit Control Act of 1985, RDS payments are subject to sequestration—a mandatory federal payment reduction. Since April 2013, CMS has applied a 2 percent reduction to RDS reconciliation payments (with a temporary suspension from May 2020 through March 2022 due to COVID-19). Beginning in January 2024, CMS began applying sequestration reductions to both interim and final payment requests.

Employer Eligibility

Employers, regardless of tax status, may qualify for the RDS if they:

- Provide retiree health coverage (including prescription drugs) under a group plan.

- Offer creditable prescription drug coverage (and issue required creditable coverage notices to retirees).

- Submit an actuarial attestation showing that the plan’s drug coverage is at least equal in value to standard Part D coverage.

To qualify, coverage must pass a two-part actuarial equivalence test: a gross value test (used for general creditable coverage determinations) and a net value test (which considers employer contributions). The net value test applies only in the RDS context.

Tax Treatment

RDS payments are not taxable, but employers cannot deduct the subsidy amount under the Affordable Care Act.

Application Process

Plan sponsors must apply electronically through CMS, usually no later than 90 days before the start of the plan year (extensions may extend this to 30 days). Applications must include:

- An actuarial attestation of creditable coverage.

- Identifying information for each retiree, spouse, or dependent expected to qualify.

CMS verifies eligibility against Medicare records and informs employers which retirees qualify for the subsidy. Sponsors must also certify that creditable coverage disclosure notices are provided to participants and CMS.

Employers must keep application records, including actuarial attestations, for six years and keep retiree information updated.

Payment Options

Subsidy payments may be requested monthly, quarterly, annually, or on an interim annual basis. Once approved, payments are deposited electronically into the employer’s EFT account. Notices of deposits are posted to the employer’s online RDS account.

CMS maintains an online RDS Center that provides tools, applications, and resources for plan sponsors.